Potential Winners and Losers if the Strait of Hormuz is Closed

Rokna Political Desk: The closure of the Strait of Hormuz, one of the world’s most strategic waterways, could severely disrupt the global energy market and potentially multiply oil prices several times over. Among the major losers in such a scenario would be countries like China and India.

Threats to close the Strait of Hormuz have long been one of Iran’s strategic responses to political and security pressures. While historically such actions may have primarily targeted Western countries, today the implications have shifted significantly.

According to Fararu, Iranian officials, analysts, and media outlets such as Kayhan periodically raise the possibility of blocking the Strait. Recently, Yaqub Rezazadeh, a member of the National Security Commission of Iran’s Parliament, stated: “If our enemies prevent Iran from selling oil, we will not allow passage through the Strait of Hormuz.” This report examines the political and security dimensions of such an action.

The Onset of Conflict in the Persian Gulf

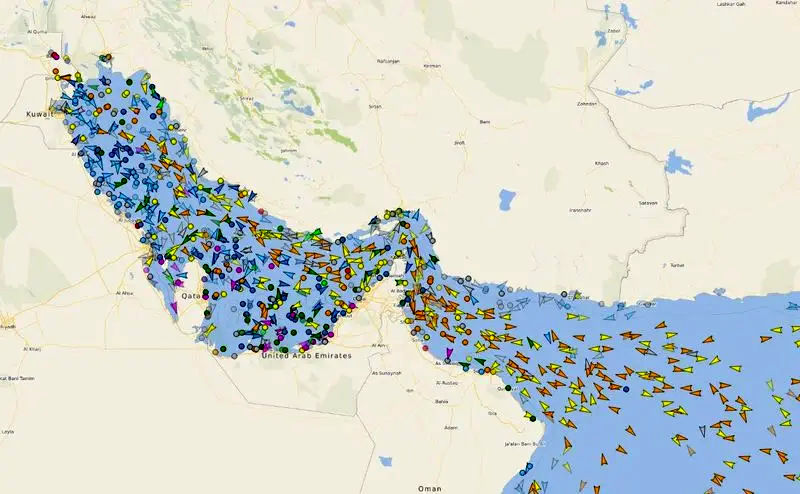

A military blockade of the Strait of Hormuz could be implemented in various ways. Main scenarios include targeting a few ships using drones and missiles or destroying them with naval mines. Given that the entire strait is not navigable, two channels, each about three kilometers wide, are designated for ship traffic. All these passages are within Iran’s striking range, meaning that any such military scenario could effectively block shipping in the Strait.

The Strait of Hormuz remains one of the world’s busiest maritime passages.

Historically, closure of the Strait has been considered a last resort. If implemented, Iran would not only disrupt global energy markets but also engage with Gulf countries, China, India, and the United States. The nature of these conflicts varies: Gulf states are oil exporters dependent on the strait, countries like China and India are major importers, and the U.S. would suffer primarily from rising oil prices rather than supply issues. Notably, Iran has spent at least five years attempting to rebuild relations with its southern Gulf neighbors.

Key Oil Exporters Dependent on the Strait

Closure of the Strait would directly impact oil and condensate exports from Gulf countries. Saudi Arabia, the UAE, Qatar, Iraq, Kuwait, and Iran rely on this route for maritime oil exports. In recent years, Gulf states have invested in pipelines and alternative routes to reduce dependency on the Strait. The UAE, Iraq, and Saudi Arabia are leading this effort:

-

Saudi Arabia is expanding pipelines to transport oil, petrochemical products, and condensates from its eastern provinces to the Red Sea.

-

UAE has a pipeline along the Oman border transporting oil to the port of Fujairah, bypassing the Strait.

-

Iraq sends oil from northern fields in Kirkuk to Ceyhan, Turkey.

-

Iran is developing a pipeline from Goreh to Jask on the Gulf of Oman, though it is not yet operational.

-

Oman does not rely on the Strait due to its geography.

While bypass projects are actively pursued, their operational capacities remain lower than their nominal capacity.

Major Importers at Risk

The global energy market is highly sensitive to disruptions in the Strait of Hormuz. Estimates suggest that oil prices could rise by two to five times if the strait were blocked. Among the top five crude oil importers, China and India would be the hardest hit. Key import sources for leading countries include:

-

China: Russia, Saudi Arabia, Malaysia (including Iranian crude), Iraq, Oman, UAE

-

USA: Canada, Mexico, Saudi Arabia, Iraq, Brazil, Colombia

-

India: Russia, Iraq, Saudi Arabia, UAE

-

South Korea: Saudi Arabia, UAE, USA, Kazakhstan, Kuwait, Qatar

-

Japan: USA, Saudi Arabia, UAE, Australia

The immediate impact of a blockade would be felt in Asia, particularly in China, which relies on the Middle East for roughly 34% of its crude oil imports (2024 data). Industrialized countries would also face higher energy costs, with the U.S. exposed primarily through price increases, as 60% of its oil imports come from Canada, followed by Mexico (7%), Saudi Arabia (4%), and Iraq (3%).

Likely Winners

Oil-exporting countries less dependent on the Gulf would benefit most from such a scenario, with Russia at the forefront. Already facing oil sanctions similar to Iran, Russia has positioned itself as a shadow competitor in the global oil market. Rising oil prices and potential disruption of Gulf exports, including Iran’s, would provide Moscow with a strategic advantage.

Send Comments